Government Export Schemes 2026: RoDTEP, PLI, and Duty Drawback Explained

Are you leaving free money on the shipping dock?

As an Indian exporter in 2026, are you absolutely sure you are claiming every single rupee the government is offering you? Or are you letting profit margins slip away because the paperwork is too confusing?

The Indian government wants your goods to be competitive globally. To make that happen, they offer financial incentives. But let’s be honest: the alphabet soup of acronyms—RoDTEP, PLI, DBK—can be overwhelming.

Many exporters focus solely on getting the order and shipping the goods, completely overlooking the financial benefits that are rightfully theirs. This is a costly mistake.

Greetings from Hospitor Management Pvt. Ltd. We are your trusted, IATA-accredited logistics partner and IEC holder (Code: AAGCH6090L) based in Ahmedabad. We don't just move your cargo; we help you navigate the complex EXIM landscape to maximize your profits.

In this guide, we will cut through the jargon and explain the three most critical Government Export Schemes in India for 2026 in plain English.

Understanding and claiming government export subsidies is crucial for boosting your overall profitability in 2026.

Decoding the Key Export Schemes of 2026

These schemes are not "free gifts"; they are strategic tools designed to make Indian products cost-competitive in the international market. Let's break them down.

1. RoDTEP: Remission of Duties and Taxes on Exported Products

Think of RoDTEP as the government's flagship scheme to ensure you aren't exporting taxes. It replaced the older MEIS scheme.

What is it?

RoDTEP is designed to refund you for the various central, state, and local taxes, duties, and levies that are "embedded" in your production cost but were previously not being refunded. These include things like:

VAT on fuel used in transportation.

Mandi tax.

Duty on electricity used during manufacturing.

Why it matters in 2026:

Without RoDTEP, these hidden taxes get added to your final product price, making your goods more expensive than competitors from other countries. RoDTEP gives you that money back, allowing you to lower your prices without sacrificing profit, thus making your products globally competitive. The rates vary by product HSN code.

2. PLI: Production Linked Incentive

While RoDTEP is about refunding taxes, PLI is about rewarding growth. This scheme is a game-changer for manufacturers looking to scale up.

What is it?

The PLI scheme provides financial incentives to companies based on the incremental sales of products manufactured in domestic units. In simple terms, the more you produce and sell over a base year, the more incentive you get.

Who is it for?

It is targeted at specific, high-growth sectors where India wants to become a global manufacturing hub. Key sectors benefiting in 2026 include:

Electronics and IT Hardware.

Pharmaceuticals.

Textiles and Apparel.

Automobiles and Auto Components.

Why it matters:

If you are a manufacturer in a PLI-covered sector, this scheme provides a direct financial boost that can be reinvested into expanding your capacity, upgrading technology, and dominating the market.

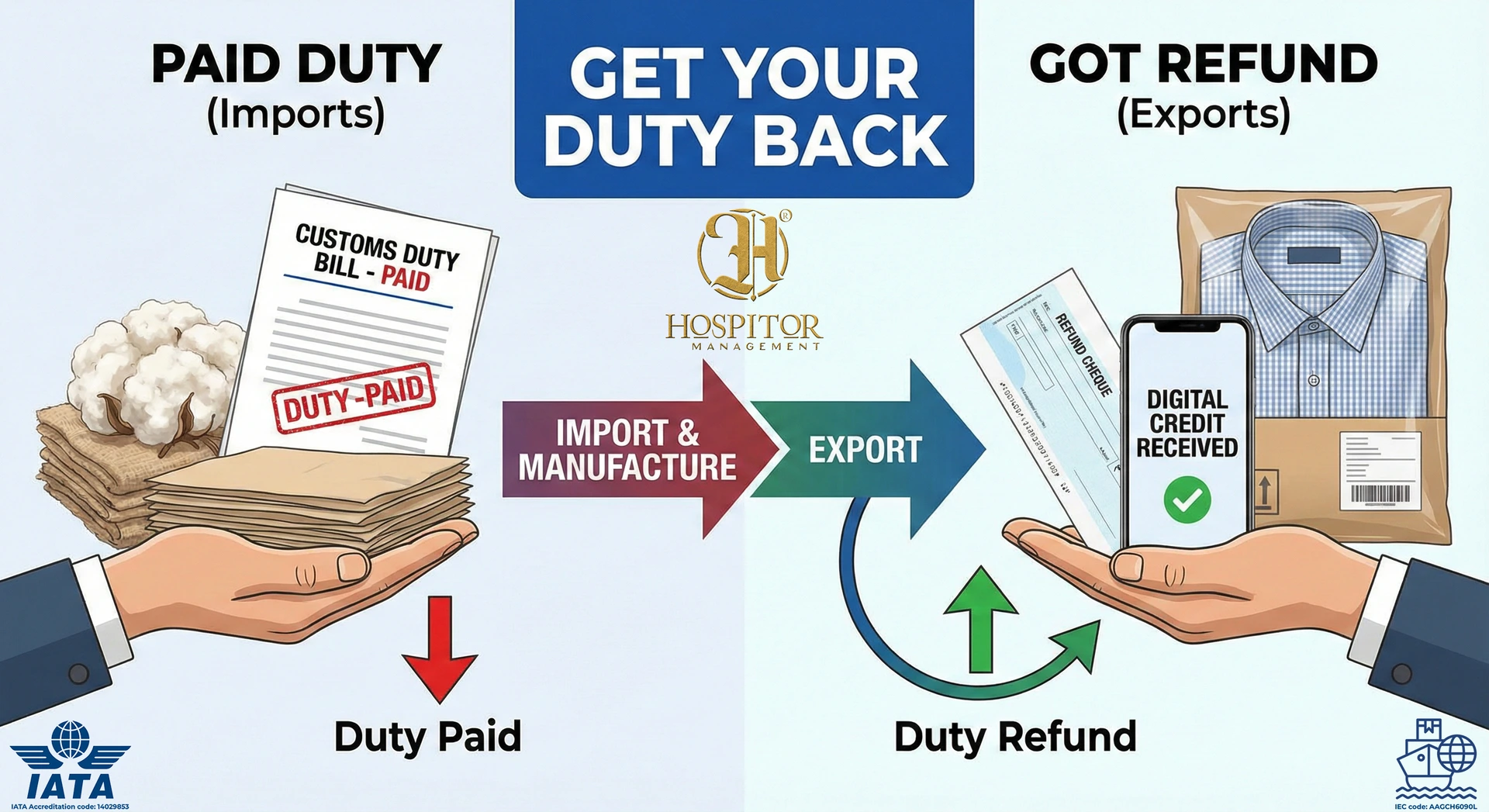

The Duty Drawback (DBK) scheme allows exporters to reclaim customs duties paid on imported raw materials used in their final exported products.

3. Duty Drawback (DBK)

This is one of the oldest and most fundamental export incentive schemes.

What is it?

If you import raw materials, components, or packing materials and use them to manufacture a product that you then export, you have paid customs duty on those imported inputs. The Duty Drawback scheme allows you to claim a refund of those customs duties.

Why it matters:

It ensures that your final export price is not inflated by the customs duties of the imported materials used. This is vital for industries that rely heavily on imported components to create finished goods for the global market. There are two types: "All Industry Rates" (AIR) which are fixed averages, and "Brand Rates" which are calculated specifically for your product.

Don't let paperwork errors cost you money. Partner with EXIM experts to ensure your documentation is perfect for claiming all entitled benefits.

The Hospitor Advantage: Moving from "What" to "How"

Knowing these schemes exist is the easy part. The hard part is filing the documentation correctly to actually get the money.

A small error in your shipping bills, a mismatch in HSN codes, or incorrect filing can lead to your claim being rejected or stuck for months. The government wants to give you this benefit, but your paperwork must be flawless.

This is where Hospitor Management Pvt. Ltd. steps in.

We are not just logistics providers; we are your EXIM strategy partners. Our team understands the intricate link between logistics documentation and scheme compliance. We ensure your shipping bills are filed correctly from day one to maximize your eligible claims under RoDTEP, DBK, and other schemes.

Stop guessing. Start claiming.

Don't leave your hard-earned money on the table. Let's review your product portfolio and identify all the benefits you are entitled to.

📞 Connect with Hospitor Today:

Call/WhatsApp: +91 6356-888866

Website: www.hospitorm.com

Visit Us: Satellite, Ahmedabad

Stay Updated on EXIM Trends:

🎥 YouTube: Subscribe Here

📢 WhatsApp Channel: Join Here

📸 Instagram: @hospitor_management

Logistics. Travel. Hospitality. We manage it all — the Hospitor Way.